The POL price debate is entering a new chapter as analysts question whether Polygon’s long-anticipated “stablecoin supercycle” could be the catalyst that reverses its sluggish market performance. With stablecoin adoption exploding across banks, fintech platforms, sovereign issuers, and commerce networks, Polygon finds itself positioned at the center of a trillion-dollar transformation.

The question now is simple: can this supercycle drive enough demand, liquidity, and real-world utility to reignite POL’s long-term value? Early signals suggest that the answer may depend on how fast (and how widely) global institutions issue tokenized money over the following years.

Is the Stablecoin Supercycle Real and Why Does It Matter for Polygon?

The “stablecoin supercycle” is no longer a fringe theory. Polygon’s Global Head of Payments and RWA, Aishwary Gupta, forecasts that over 100,000 stablecoins will be issued by 2030, not just by crypto-native companies but also by banks, corporations, sovereign governments, and global commerce platforms. This marks a shift from speculative crypto to infrastructure-level digital money.

LATEST:

We are at the start of a stablecoin "super cycle" that could see over 100,000 different stablecoins created within five years, Polygon's global head of payments & RWA, Aishwary Gupta, told The Fintech Times. pic.twitter.com/EWfWvudELV

— CoinMarketCap (@CoinMarketCap) November 29, 2025

The drivers of this trend are powerful. Banks need to stop capital flight into higher-yield on-chain assets. Corporations want closed-loop currencies that retain consumer value. Nations aim to reinforce their monetary systems by tokenizing their own stable units. Even consumer apps want to eliminate card-network fees by minting internal digital currencies.

Gupta argues the narrative is misunderstood: stablecoins do not weaken monetary control; they enhance it, as USD stablecoins have boosted global dollar demand. Banks will likely issue their own deposit tokens, allowing users to transact on-chain without moving funds off-balance sheet. As competition increases, thousands of tokens emerge, and the market fragments – creating a need for neutral settlement layers.

Stripe is now rolling out USD-settled stablecoin payments across Ethereum, Base, and Polygon pic.twitter.com/7yLghL28vS

— Adam | RWA.xyz (@adamlawrencium) December 7, 2025

This is where Polygon’s stack shines. With ultra-low fees (under $0.002), scalable throughput, and integrations across Visa, Stripe, Shopify, and Revolut, Polygon already processes 3M transactions per day and holds over $1.24B in stablecoin supply. If the supercycle becomes reality, Polygon becomes one of the global highways for tokenized money.

DISCOVER: 16+ New and Upcoming Binance Listings in 2025

Can Polygon Capture Enough of the Stablecoin Crypto Boom to Transform Its Ecosystem?

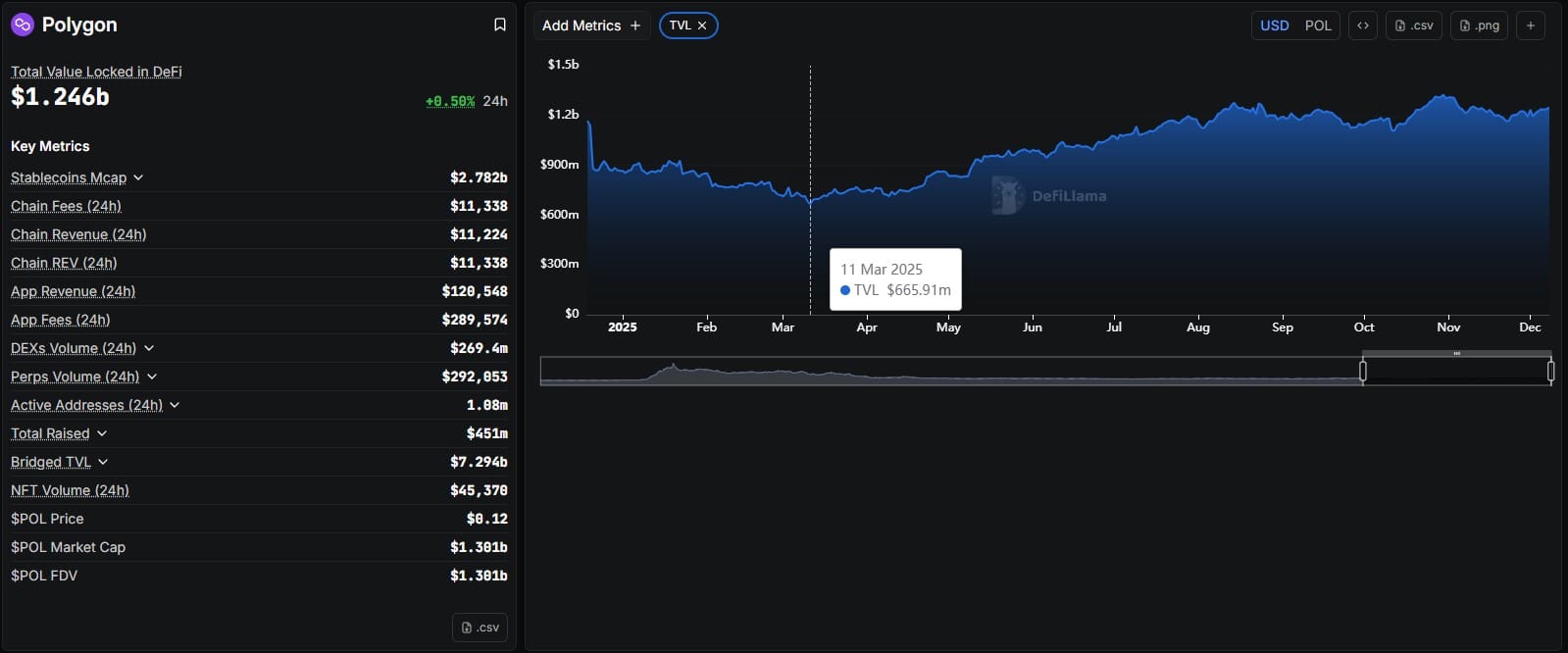

Polygon has quietly become a backbone for real-world payments flows. The network processed $4.3Bn in Q2 2025, commands 32% of all global USDC P2P transfers, and has added approximately $700M in new TVL this year. With the AggLayer expected to unify liquidity across chains, Polygon could become the settlement mesh for thousands of interoperable stablecoins moving across apps, banks, and markets.

(Source – DeFiLlama)

This would dramatically improve POL’s economic model. Staking POL secures the network, earns fee revenue, and positions the token as the core asset backing Polygon’s multi-chain architecture. A surge in stablecoin velocity would directly increase fees and network activity – key ingredients for a sustainable price recovery.

Yet market sentiment remains mixed. With POL trading near $0.12, many predictions are bearish or stagnant, citing layer-2 competition and migration delays. But if the stablecoin supercycle unfolds as Polygon predicts, POL could be one of the biggest beneficiaries of the next wave of digital money.

DISCOVER: 15+ Upcoming Coinbase Listings to Watch in 2025

POL Price Prediction: Can Technical and Fundamentals Align?

Despite its challenging year, POL price action is showing early signs of stabilization. On the daily timeframe, POL has successfully defended the $0.12 support, forming a potential bottom and hidden bullish divergence since the October 10 crash.

(Source – TradingView)

RSI is deep in oversold territory but rising – often a precursor to strength returning to the market.

The MACD has flipped slightly positive, signaling that sellers are losing dominance while buyers accumulate cautiously. The key overhead barrier is the $0.21 level, which aligns with the 200 EMA and 200 SMA lower band – a significant technical resistance.

(Source – TradingView)

Zooming into lower timeframes, POL is compressing tightly beneath a diagonal resistance line, forming a small ascending triangle. This pattern often resolves upward, especially when paired with oversold momentum and improving market conditions, such as BTC reclaiming $90K. A breakout + retest of the $0.21 zone would be the strongest confirmation that a sustained rally is underway.

Still, the volume remains the missing ingredient. If the stablecoin narrative accelerates, POL could reclaim higher ranges faster than many expect.

DISCOVER: 10+ Next Crypto to 100X In 2025

Join The 99Bitcoins News Discord Here For The Latest Market Updates

Key Takeaways

The post Will Stablecoin Supercycle Save POL Price Prediction? appeared first on 99Bitcoins.