Solana’s price relating to upgrade stack, rising developer activity, and improving technicals could support a move toward the $150 resistance if network traction and trading volumes continue.

Summary

- Solana price includes planned upgrades like Alpenglow, MCP, and BAM to fix core issues, reduce voting overhead, and harden consensus after external research flagged vulnerabilities.

- Developer tools and apps across prediction markets, gaming, and AI keep activity elevated, even as speculative memecoin phases fade and users shift to practical use cases.

- SOL trades above short-term moving averages with rising momentum, but analysts view the prior $150 peak as a key resistance that requires sustained volume and network progress.

Solana’s (SOL) price has drawn market attention following a series of network upgrades and technical developments that analysts say could support price movement toward $150 by year-end, according to industry observers.

The blockchain network has announced multiple planned upgrades including Alpenglow, MCP, BAM, Harmonic, XDP, and p-token, each designed to address technical issues within the network’s core infrastructure, according to project documentation. Development teams have released tools including Dflow, Meridian, Humidifi, Nous, MetaDAO, Ore, FlashTrade, Orb, and Dupe, indicating continued developer activity across multiple categories.

Solana price targets bullish levels

The network’s user composition has shifted following the conclusion of a memecoin distribution phase, with remaining participants focusing on practical applications rather than speculative tokens, according to network data. Solana has gained visibility across retail and institutional sectors in recent quarters, with access expanding through a neobank partnership and a multi-year gaming project positioning the network within the gaming sector.

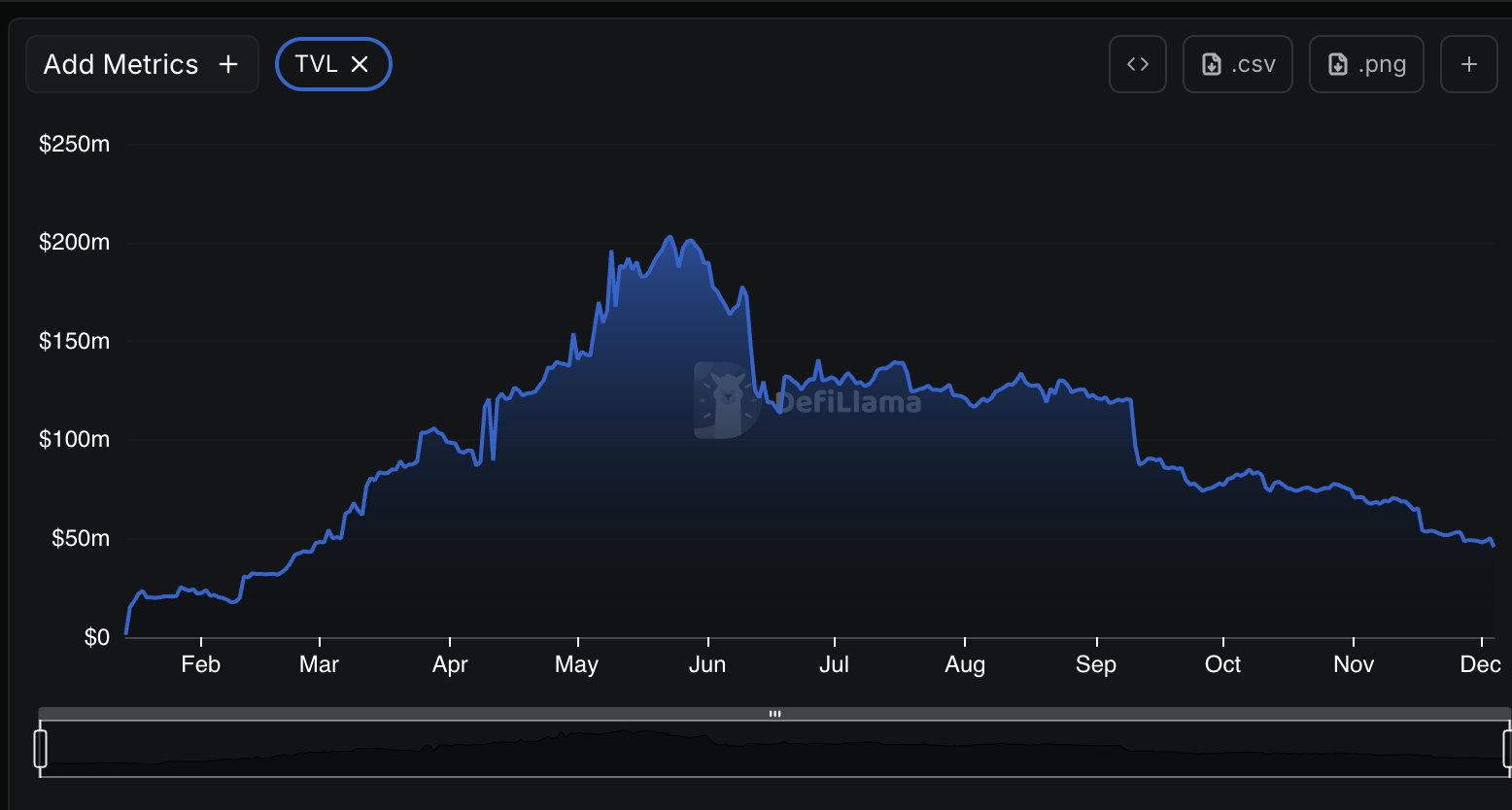

Network metrics currently register below previous peak levels, though baseline activity remains higher than in prior market cycles, according to blockchain analytics. Solana holds leading or second-place positions in prediction markets, x402 applications, and artificial intelligence-linked projects. The network’s Breakpoint conference is scheduled to proceed as its largest event to date.

The Alpenglow upgrade has emerged as a focal point in technical discussions. The update reduces on-chain voting activity, modifies consensus mechanisms, and resolves a vulnerability where minimal stake could halt chain operations, according to technical specifications. A research paper from ETH Zurich prompted revisions to system architecture, reflecting what developers describe as a research-driven approach to network development.

Cardano researchers noted similarities to their methodology of publishing formal research papers prior to implementing major protocol changes, according to public statements. The approach represents a shift toward structured technical development for Solana, which observers suggest may strengthen confidence in future updates.

December has historically produced varied returns for cryptocurrency markets, with the month typically generating elevated trading volumes, according to market data. Current technical indicators show Solana’s price trading above short-term moving averages with rising momentum indicators and volume levels sufficient to support significant price movement, according to technical analysis.

Market analysts state that sustained network upgrades and trading activity will serve as key indicators for whether Solana can approach projected year-end price targets. The cryptocurrency traded at approximately $250 during previous market peaks, establishing the level as a significant resistance point.