China Reiterates Crypto Ban While Cracking Down on Tokenized Assets and Yuan Stablecoins

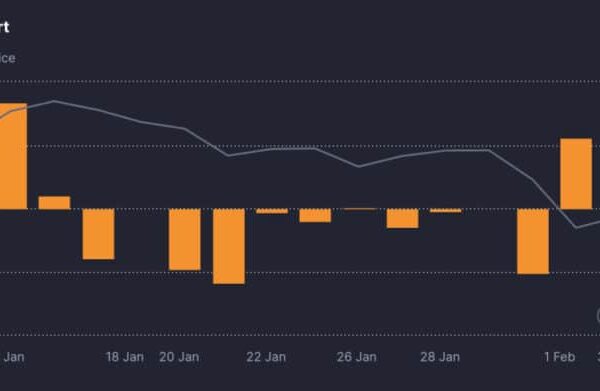

Like clockwork, China FUD is back just as Bitcoin slips into bear-market territory. Beijing has widened the scope of its cryptocurrency ban, explicitly targeting the tokenization of real-world assets and unauthorized stablecoins linked to its currency. China just reminded the global market that its door to cryptocurrency remains firmly shut. In a coordinated move involving…