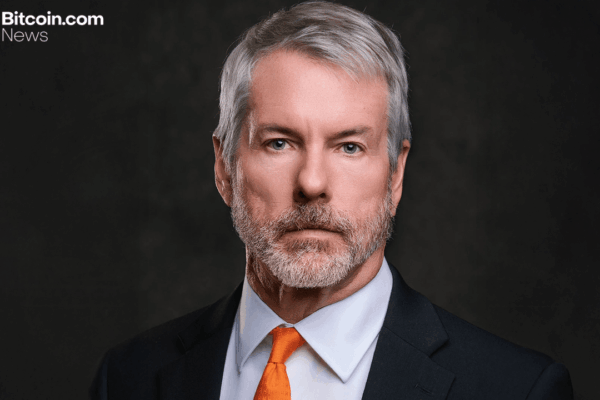

Strategy’s Boss Hints at New Bitcoin Accumulation as Unrealized Loss Tops $3.4 Billion

On Sunday, Strategy founder Michael Saylor hinted in a recent X post that his company has likely added to its bitcoin holdings. “Orange Dots Matter,” Saylor said, even as his firm’s current bitcoin position sits below its cost basis. Saylor Sticks to the Script With Another Bitcoin Tease It appears Strategy is poised to disclose…